Residential Real Estate Trends

National Association of Realtors (June, 2011)

Rent or Buy? Do the Math.

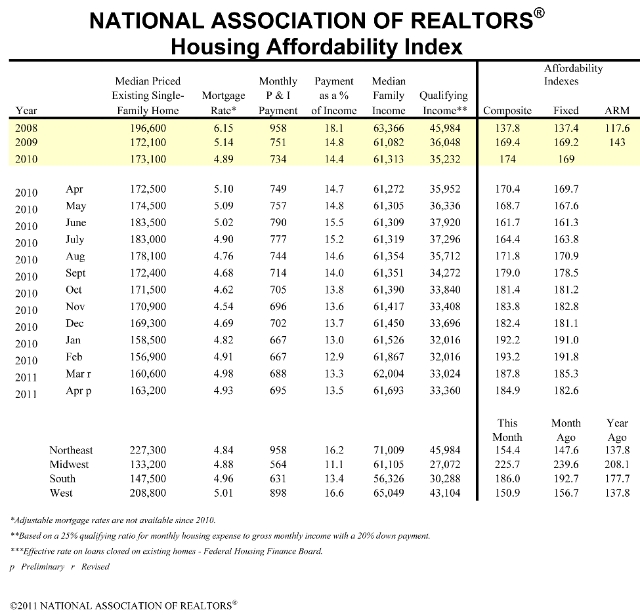

Owning a home has never been more affordable than in today’s market, according to NAR’s Housing Affordability Index.

The affordability index compares median income, median home price and mortgage rates. An index value of 100 means a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home, assuming a 20 percent downpayment. The index rating has fluctuated within the 180 to 200 range since the beginning of this year. An HAI of 180 means that a family earning the median income has 180 percent of the income needed to qualify for a mortgage on a median priced home.

For deeper perspective, consider a family with an annual income of $60,000 renting at $1,000 per month. By comparison, a 30-year mortgage payment on a $170,000 home at the current rate of 4.5 percent, assuming a 20 percent downpayment, would be $700 per month.

Affordability Index Report: